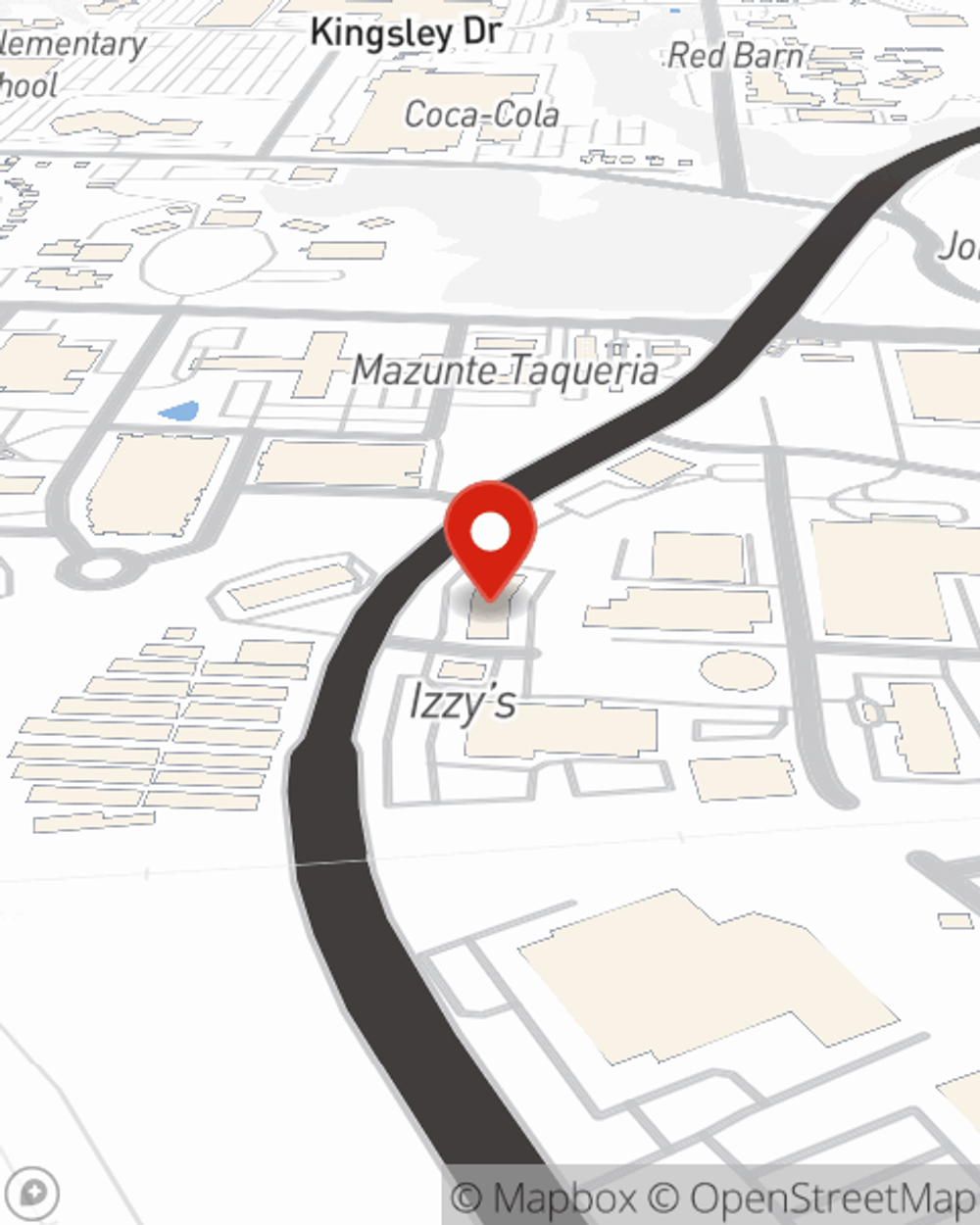

Business Insurance in and around Cincinnati

Get your Cincinnati business covered, right here!

Cover all the bases for your small business

- Dayton

- Columbus

- Toledo

- Cleveland

- Akron

- Canton

Help Prepare Your Business For The Unexpected.

Preparation is key for when a problem happens on your business's property like a customer stumbling and falling.

Get your Cincinnati business covered, right here!

Cover all the bases for your small business

Customizable Coverage For Your Business

With options like worker's compensation for your employees, extra liability, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Joe Dougherty is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Take the next step of preparation and contact State Farm agent Joe Dougherty's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Joe Dougherty

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.